Luxembourg insurance solutions are recognized wealth management and estate planning tools.

Their success is based on an optimal protection plan and flexible asset management.

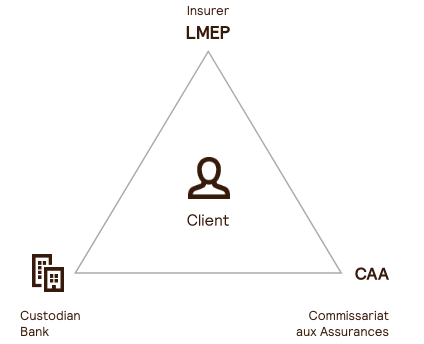

The Triangle of Security

The protection scheme in Luxembourg is based on the legal and physical separation of the assets underlying the insurer’s obligations to its clients (the “separated assets”) and the insurer’s other assets.

In practice, the underlying assets are deposited separately from the Insurer’s other assets with a Custodian bank approved in advance by the Commissariat aux Assurances (Insurance Commission).

The “Triangle of Security” takes effect through the signature of a three-way custodian agreement between the Insurer, the Custodian bank and the Commissariat aux Assurances.

The Super-Privilege

In the event of the insurer defaulting, the claims of investors and their beneficiaries take precedence over those of other creditors with regard to the separated assets. This privilege outranks all other creditors, including the State, the Treasury and the Insurer’s employees.

Our Wealth Insurance and protection offers

We are completely focused on developing insurance solutions that meet our partners’ needs and our clients’ specific expectations.